In a previous post, I discussed the Top 4 Reasons to Roll Over Your Old 401K to an IRA. Please use this post as a guide to understand your options and how best to proceed with your old employer provided retirement plan.

The goal of this blog post is to speak specifically about the process of rolling over a previous employer plan with the help of FinTech company, Capitalize.

Capitalize saw a problem created over the course of many years and has now provided an incredible solution for individuals. Capitalize’s whole mission is to help you find old 401ks and roll them over into new or existing IRA accounts.

Why such a demand or push to roll over your 401K?

“As of May 2021, we estimate that there are 24.3 million forgotten 401(k)s holding approximately $1.35 trillion in assets, with another 2.8 million left behind annually.”

Forgotten.

It’s hard to imagine that people would just “forget” about their money, but they do. I have heard multiple individuals throughout my career claim that they “forgot about that one” or “oh yeah, I did work there for a year or two.”

Maybe it is such a minimal amount, or they have enough and don’t want to go through the headache of paperwork to roll it over, or perhaps they truly have forgotten because so much time has passed.

Whatever the reason is, I view this as over a trillion dollars with the potential of being wasted away and not used in accordance with how the contributor would have wanted. That is both unfortunate and a completely missed opportunity to provide for yourself and others.

If you are someone who has recently left a job or has an outstanding 401K at a previous employer, I strongly encourage you to act quickly on this. Life gets busy, the demands of our jobs, our families and our lives make it difficult to prioritize these administrative tasks.

But the good news is that Capitalize has made the process SO easy for you going forward, we no longer have an excuse to do nothing!

I Used Capitalize Myself and I Wanted to Share My Experience

I went through the process with Capitalize and rolled over my previous 401K to a new Traditional IRA because before I make recommendations or speak specifically about a company I want to be sure I have faith in the product or service.

I worked in the financial services industry and have rolled over many 401Ks for both myself and previous clients and I can tell you first hand it is an antiquated and time consuming process.

Here’s the thing though, Capitalize has completely transformed this process and has made the once upon a time cumbersome and confusing task of rolling over a 401K into a simple, efficient and straight forward one.

There is No Cost to You to Use this Service

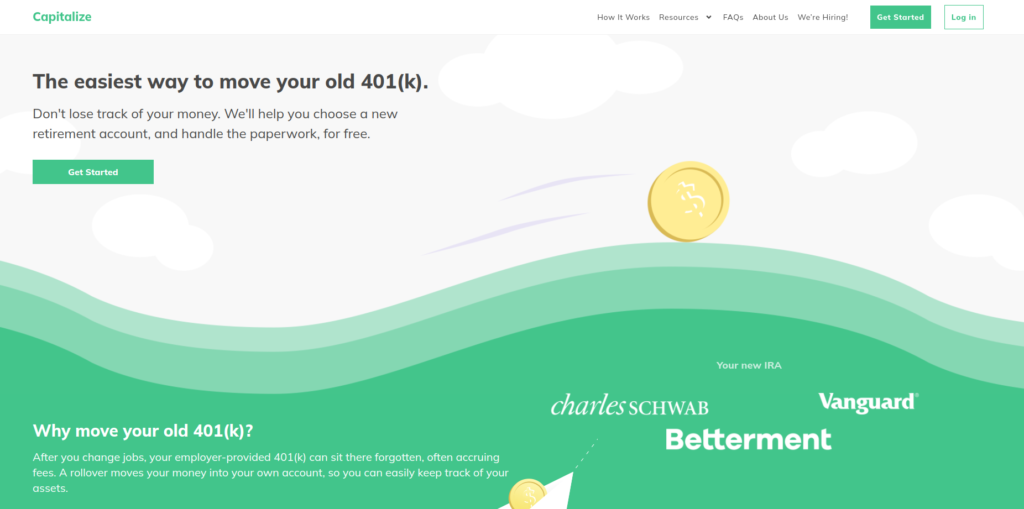

Why you ask? Because the financial institutions that you choose to roll over your accounts to, will pay Capitalize for bringing business to their firm. The choice is yours, Capitalize does not make this decision for you. You will decide where you want to rollover your 401K and Capitalize will simply assist you in that process.

Here is a breakdown of the steps to expect when rolling over a 401K to a rollover IRA account using Capitalize

Step 1: Get Started

Click on this link which will send you directly to the Capitalize home screen where you will select, Get Started.

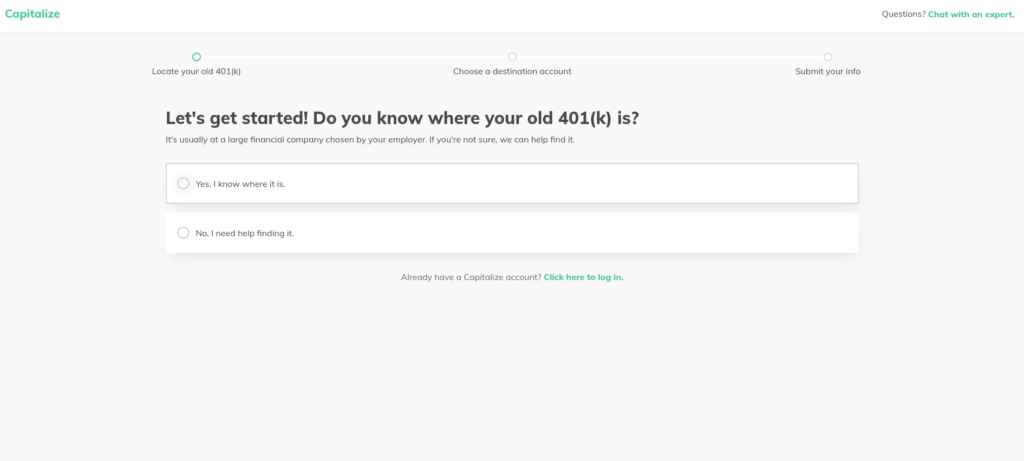

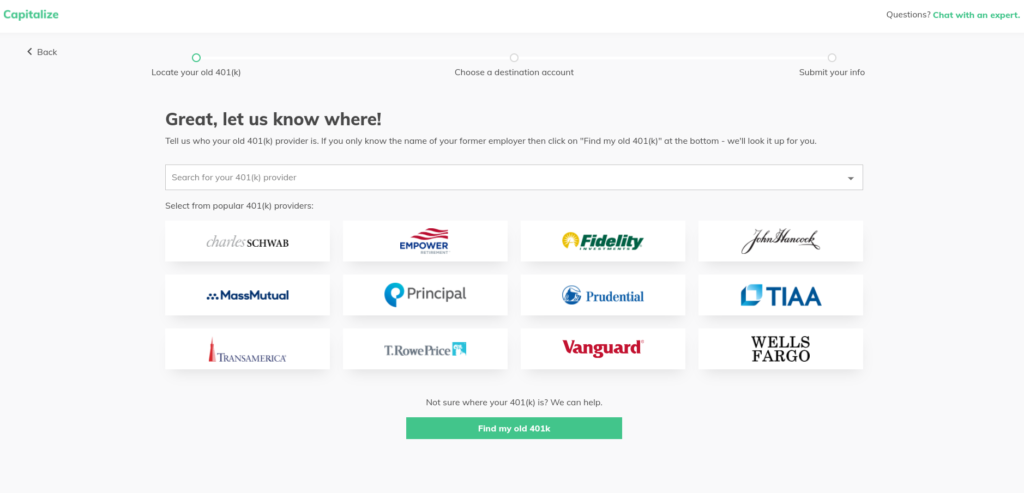

Step 2: Identify Where Your 401K Is Held

From there you will provide them with guidance around where your current 401K is held. You will select the financial institution by clicking on one of the 401K providers noted or you can search in the search bar for your specific 401K provider.

If you don’t know or remember where the old 401K is, that’s OK, they will assist you in the process of tracking it down by asking you some additional questions.

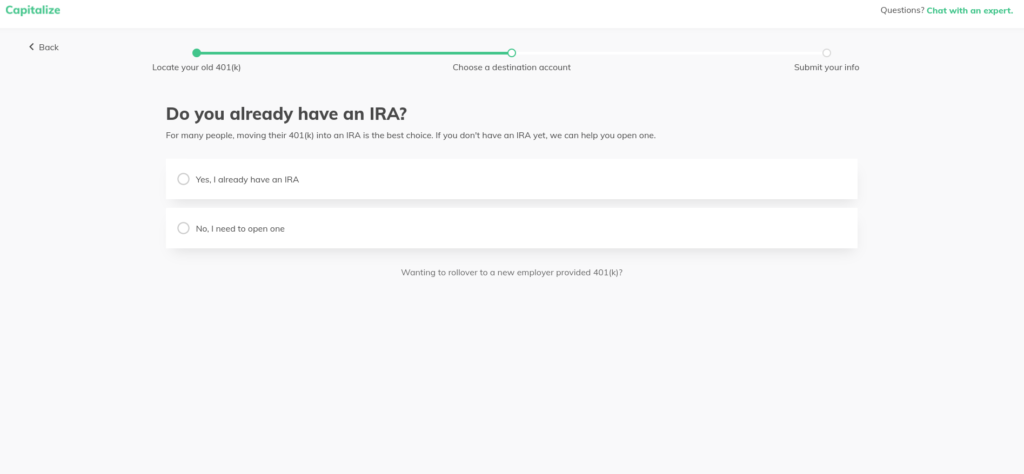

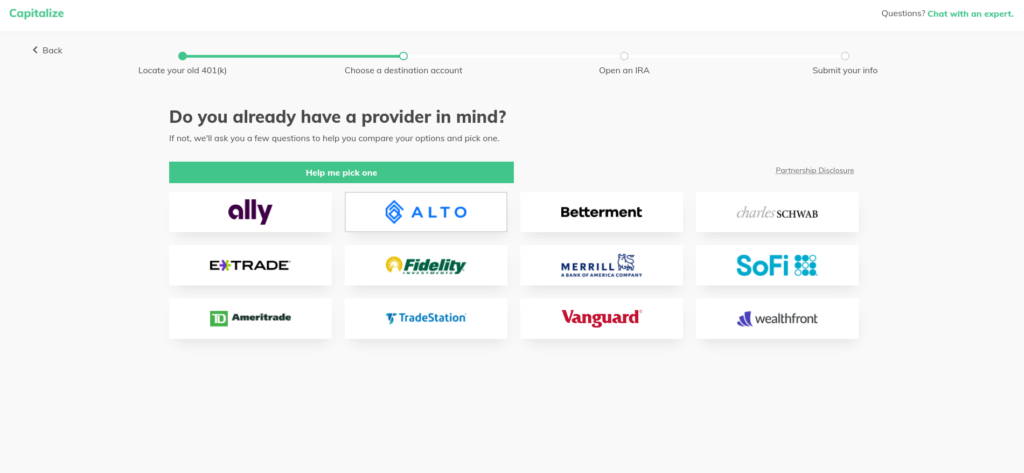

Step 3: You will Identify which financial institution you would like your 401K to be rolled over to

If you do not have an IRA opened, you will select a financial institution to open an account and transfer your assets to.

If you already have an IRA account and you are merely transferring your assets over from the 401K to the existing IRA then select which financial institution your IRA is held. Skip to Step 6.

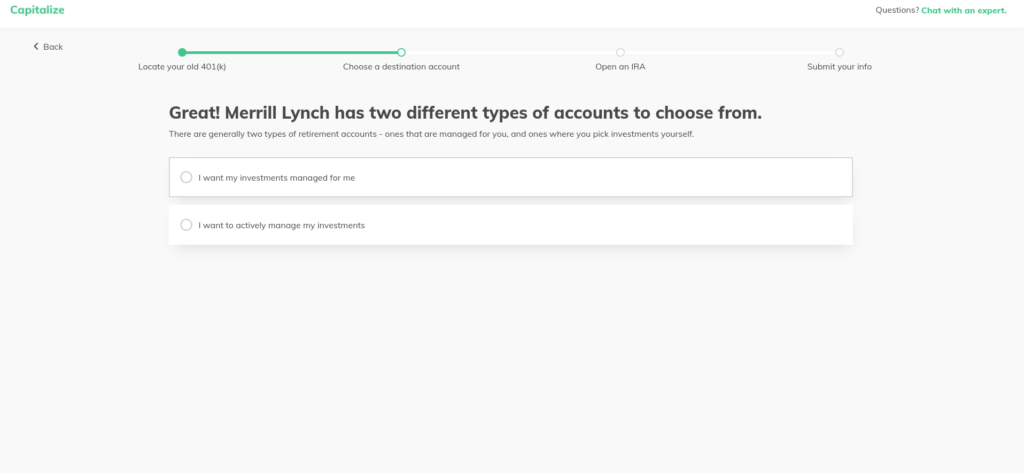

Step 4: You will choose the type of account you need to open

Depending on what firm you decide to rollover your assets to, there may be multiple account types to choose from. Typically your options will be one of the following:

- Actively managed by a financial professional

- Self-managed, meaning that you can manage the account and buy/sell your investments by yourself

- Robo-Advisor – some institutions will have the Robo advisor options in which case your investments will be selected for you based on your responses to a number of questions related to your time horizon, risk tolerance, etc. Two examples of Robo Advisors are Betterment & Wealthfront.

Step 5: It will send you to the financial institution website to create an account and begin setting up your new IRA account

For those of you needing to open an entirely new account, you will select what type of account you would like to open – a Rollover Roth IRA or a Rollover Traditional IRA.

A nice refresher for your options on how best to choose an account type:

- If you have a Roth 401K, you may rollover to a Roth IRA.

- If you have a Traditional 401K…

- You may rollover to a Traditional IRA or,

- You may rollover to a Roth IRA ***With the understanding that the full distribution and rollover will be taxed at ordinary income rates. In this scenario, you are going from a Pre-Tax (no tax yet paid) to an After-Tax (Tax already paid) investment vehicle and thus you must pay tax on the money going into the new after-tax Roth IRA as a result of the rollover.

Step 6: Provide Capitalize with the IRA account number

Step 7: Capitalize Will Schedule a Call With You To Authorize and Initiate the Transfer

Once you provide Capitalize with the Financial Institution and the account number, they will begin the rollover process.

Depending on which firm you are transferring from and to, you may be able to roll your account in one of two ways:

- In-Kind – meaning that no assets will be sold and everything you own from your old account will transfer to your new account.

- Sell Investments and Transfer cash (in most circumstances this will happen) – everything in your old plan will be sold. They will then transfer cash from your old employer plan to your new IRA account.

Capitalize will schedule a call between Capitalize, the old employer plan and you to get your final authorization to rollover the funds. This will take about 10 minutes of your time.

Step 8: Rollover Complete – Time to Invest

After you provide your verbal authorization to rollover your old employer plan, it will take a week or two (depending on the firm) to complete the rollover process.

Depending on whether or not you decided to opt into a Robo Advisor or self manage – now you will address how best to move forward with investing in the account. If your account was transferred in cash, please act quickly on this as you will want to get your assets invested and back in the market as soon as possible.

I Highly Recommend Using Capitalize to Assist with Your Rollover

Capitalize has helped tens of thousands of investors in rolling over millions of dollars, including myself. I highly recommend using them if you have an old employer retirement account out there.

As mentioned before, life gets busy. The longer you wait to roll it over, the more likely it never will be.

Resources:

Blog Post: Top 4 Reasons to Roll Your old 401K into an IRA

Need Financial Planning Assistance? Schedule a 1:1 Session with me to get you on the right track.

Tune in to new blog posts every Tuesday and Thursday!

Follow @finpoweredfemale for more personal finance, tax, investing and business ownership tips on building wealth with confidence!