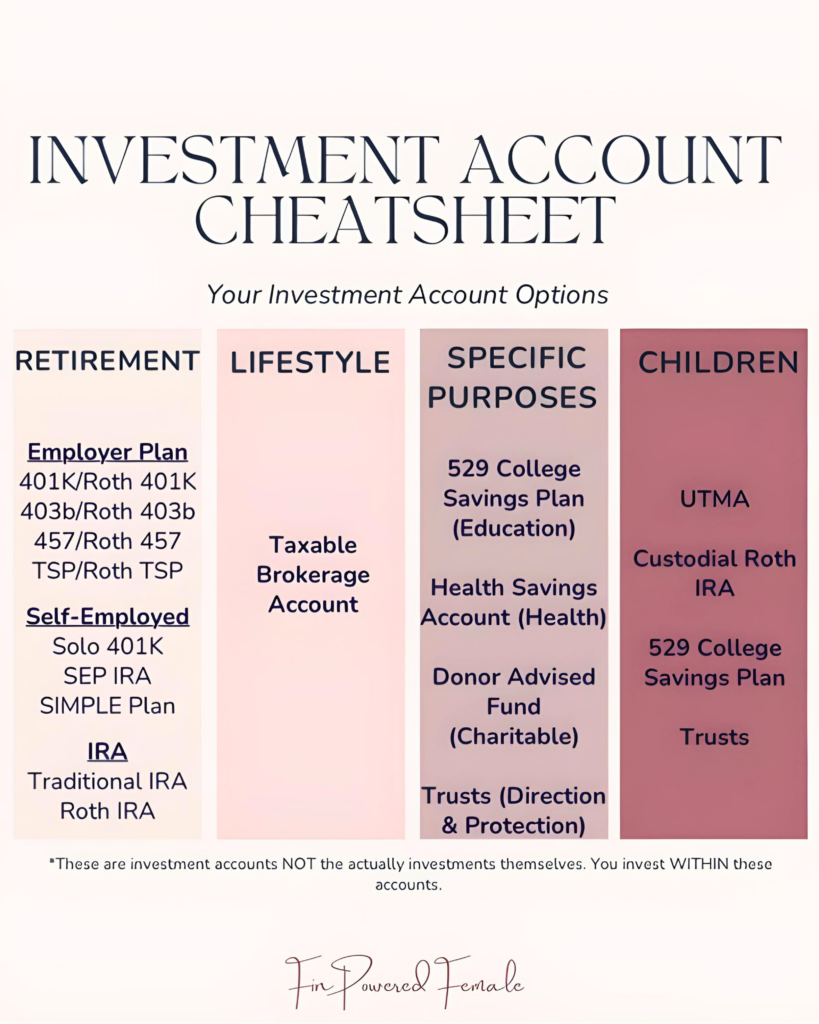

401k, 403b, and 457. SEP, Solo, and SIMPLE. IRA, HSA, and UTMA.

Have I lost you yet?!

The financial world is full of jargon and acronyms that are bewildering at best and mind-numbing at worst (even for me — and I love this stuff!). This is particularly true when it comes to the investment world and different types of investment accounts.

I get it. It’s a LOT. But don’t let the information overload get you into a negative headspace. Embrace the power of a growth (and money) mindset shift. Sure, you aren’t an expert, YET. But you’re in the right place.

We’ve all been beginners at one point in our lives for each and every single action we’re currently taking today. Once upon a time, you “couldn’t” do a great number of things. But you took that first step. You fell down, got back up, and brushed it off. You persisted. You molded habits and built a record of evidence that you can do hard things. Your financial life is no different. You’ve got all the necessary tools — you just need someone to help you decipher the manual.

Ready to crack the code of successful investment strategy and determine what types of investment accounts might be right for you?

You’re speaking my language.

What Is an Investment Account?

Investment accounts — sometimes called brokerage accounts — allow you to buy and sell securities (stocks, bonds, etc.) within them, and will hold a mixture of cash and securities. This is different from a bank account (checking/savings), which only holds cash.

In this blog, I describe various types of investment accounts and include details about why each might (or might not) pertain to you and your unique set of financial circumstances, including,

- Retirement Accounts

- Investment Accounts with a Specified Purpose

- Investment Accounts for Children

- Individual Brokerage Accounts

Each account type has its own purpose and will tie into a particular goal or set of goals in someone’s financial life. Use this as a guide to find your perfect fit.

Types of Investment Accounts

1. Retirement Account

A retirement account will have a tax-advantaged element to it with the purpose of incentivizing people to contribute to their future retirement.

- Pre-Tax or Traditional: Your contributions into the account have not been taxed yet. Your contributions and income in the account will grow tax-deferred to be taxed upon your withdrawal in retirement.

- After-Tax or Roth: Your contributions have already been taxed prior to contributing them into the retirement account. So, your contributions and income in the account will continue to grow tax-free and be withdrawn tax-free, assuming you follow the Roth guidelines. (Keep in mind that Roth 401K’s may have employer contributions included in the account and those contributions may go in pre-tax and grow tax-deferred, not tax free.)

There are three overarching types of retirement accounts, including:

- Employer-Provided Retirement Account

- Self-Employed Retirement Account

- Individual Retirement Account (IRA)

More on each of these types of retirement accounts below.

Employer-Provided Retirement Accounts (For Employees)

All of these accounts are set up for you as the employee to be able to contribute towards your retirement.

Your employer will often have a corresponding match available to you. For example, consider a scenario where your employer will match 100% of your retirement contributions up to 3% of your salary. So, if you are making $100,000 and are contributing 3% to your employer-provided plan, you can expect to receive roughly $3,000 in your retirement account from the employer match. Cha-ching! That’s free money! Your goal should be to contribute up to the employer match, at a minimum.

Types of employer-provided retirement accounts include:

- 401k Plan: *Most common retirement plan account* Designed for Corporations and For-Profit Organizations.

- 403b Plan: Designed for Non-Profit Organizations like public schools, hospitals, etc.

- 457 Plan: Designed for State and Local Government Employee

- TSP Plan: Designed for Federal Government Employees and Uniformed Services Members

Self-Employed Retirement Accounts (For Entrepreneurs)

These are specifically designed to support the self-employed and small business owner. Each of these options has its own set of advantages and disadvantages.

Types of self-employed retirement accounts include:

- SEP IRA

- Meant for small business owners with minimal to no employees

- No reporting required.

- Contributions to retirement accounts may be used to offset your business income (if contributing to a Traditional SEP IRA).

- Solo 401k

- Best for those who do not have employees.

- There is an element of administration and reporting for this type of retirement plan.

- There is both a Roth and Traditional option for Solo 401k’s.

- SIMPLE Plan

- Meant for larger businesses of up to 100 employees.

Individual Retirement Accounts (IRAs) *For Everyone*

Individual retirement accounts (IRAs) are designed for individuals who may or may not have access to an employer-provided retirement plan but want an opportunity to contribute to their retirement.

The only requirement to contribute to an IRA is that you must have earned income. This is income through wages, employment, or compensation of some kind.

Types of individual retirement accounts (IRAs) include:

- Traditional IRA

- Anyone can contribute so long as you have earned income and note that there are no income limitations.

- Growth in the account will grow tax deferred, meaning it will not be taxed until you withdraw the funds in retirement.

- Roth IRA

- Income limitations.

- After-tax contributions.

- Money in account grows tax-free and withdrawals are tax-free in retirement.

Note: There are annual limitations on how much you can contribute to an IRA in any given year. Be sure to stay up to date on the IRS rulings.

2. Investment Account with a Specified Purpose

These investment accounts are tax-advantaged and are designed for the funds to be used for a specific purpose. In order to maintain the tax-advantaged status, the funds will need to be used for that purpose and that purpose alone. If they are not, you may be subject to a 10% penalty and/or taxation on the growth within the account.

- 529 College Savings Plan

- The funds are contributed after-tax but will grow and be withdrawn tax-free so long as the funds are used for qualified education expenses. Refer to my blog post specifically about 529 College Savings Plans for more information.

- Health Savings Account (HSA)

- This is the only triple tax advantaged investment account available to investors. The funds are contributed pre-tax and will grow and be withdrawn tax-free so long as the funds are used for qualified medical expenses. Refer to my blog post specifically about Health Savings Accounts for more information.

- Donor Advised Fund (DAF)

- This is a charitable investment account that lets you set aside money for donations while getting an immediate tax deduction. You can contribute cash, stocks, or other assets to the DAF, let the funds grow tax-free, and decide over time which charities to support. It’s a flexible, strategic way to give over time.

3. Investment Account for Children

There are several terrific ways to save for your children’s future. Each has a different purpose, tax structure and benefit, and element of control. It’s likely that more than one will make sense over time, so educate yourself on each option to determine which is going to best align with your long-term savings goals.

Three of my favorite ways to save for your children’s future include:

- Custodial Roth IRA

- 529 College Savings Plan

- UTMA

4. Individual Brokerage Accounts (For Everyone)

With an individual brokerage account, the income earned and realized throughout the year will be taxable to you in that tax year. This account will provide you with the most flexibility in that there are no maximum contributions or rules telling you that you can’t take the funds out until retirement.

You can open an account in your individual name or jointly with your spouse (note that all retirement accounts are held in individual name only). You can contribute as much or as little as you’d like and contribute or withdraw funds at your convenience.

The taxable brokerage account is a fantastic option once you have maxed out your tax-advantaged accounts OR if you are already sitting on a significant amount of cash and have already maxed out your IRA option.

Determine Which Investment Account Is Your Perfect Match

That may have been a mouthful, but there is no substitute for taking the time to invest (pun intended!) in your financial literacy and skillset development, especially when it comes to investment strategy.

When we better our finances, we better our todays AND our tomorrows. Learn more about ways to work with me and create a clear, actionable investment roadmap to achieve lasting financial success.