2022 is going to be the year we create intention with our finances and this Personal Wealth Tracker is going to make it so easy for you to do just that.

The FinPowered Female Personal Wealth Tracker is a 4-in-1 template encompassing all of the different areas that have a meaningful impact on our financial wellness and financial success. The template is broken down into the following:

Net Worth Template

Cash Flow Template

Budget Template

Financial Goal Progress Report

The template is designed to build awareness around your current financial life & habits, hold you accountable for your financial goals, and identify the action steps required for you to build the financial life you want.

We must first understand where we are before we can make changes and plans for where we want to go. Utilizing this Wealth Tracker will provide you with the level of control and understanding of your money that is required to effect positive change on your financial future.

Below I will provide you with a summary of each template – how it should be used and why it will help you going forward!

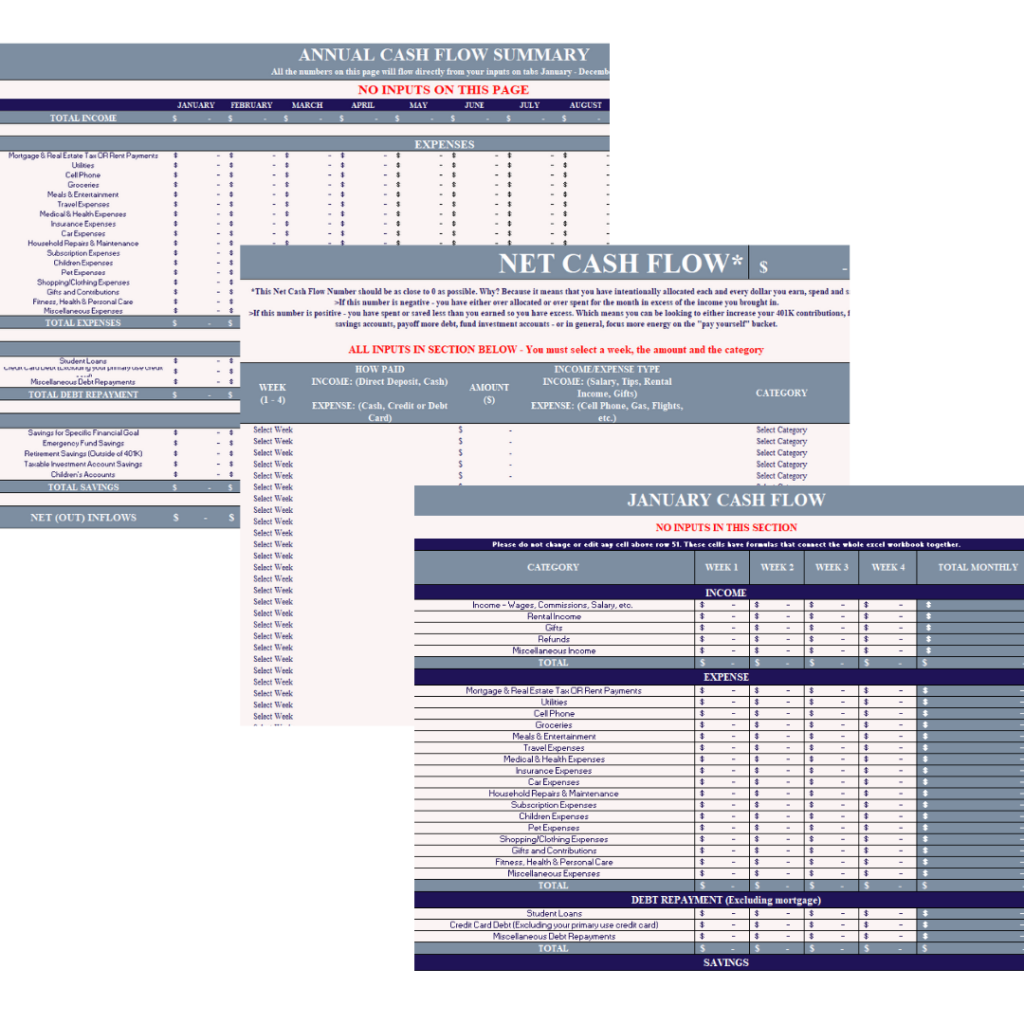

Cash Flow Template

One of the foundational tools in building wealth and structure around our financial lives is by having a clear understanding of what money is coming in and where money is going out.

Time and time again I hear the confusion of “where is my money going?” or “what am I even buying?” or “how is it that I breakeven every single month?”

But at that point, what change do we make? Are there expenses we could have done without? How much does that little expense really add up to over the course of a month? We don’t know and we won’t know unless we spend a little time tracking our expenses to get a better understanding.

The cash flow template is designed to provide you with a monthly and annual overview of your income, your spending, your saving, your investing and your debt payoff.

In tabs January – December, you will be inputting the amount spent or the amount made and selecting one of the pre-determined categories. From there, your cash flow template and budget template will automatically be filled, providing you with a monthly overview and annual summary to better identify your inflows and outflows.

The goal with the Cash Flow template is to create more awareness and intention around your money coming in and where you choose to send money out. It will show you how you have directed every dollar that came into your bank account into a bucket – an expense, an opportunity to save, invest or pay off debt.

What I want everyone to take away from the Cash Flow & January – December Tabs is a deep understanding of the following:

- What income is coming in on a monthly basis

- How much am I spending and on what

- Are there areas I can be improving or expenses I could be cutting

- Am I cash flow positive or negative every month. If positive, should I be investing more? Pay off more debt? etc. If negative, are there ways I can increase my income or ways I can decrease my spending?

- Lastly, I want you to be able to use the awareness you are gaining from understanding your expenses, to intentionally direct your money where you want it to go. The budget tab will assist in making a strategy and providing you accountability on your progress.

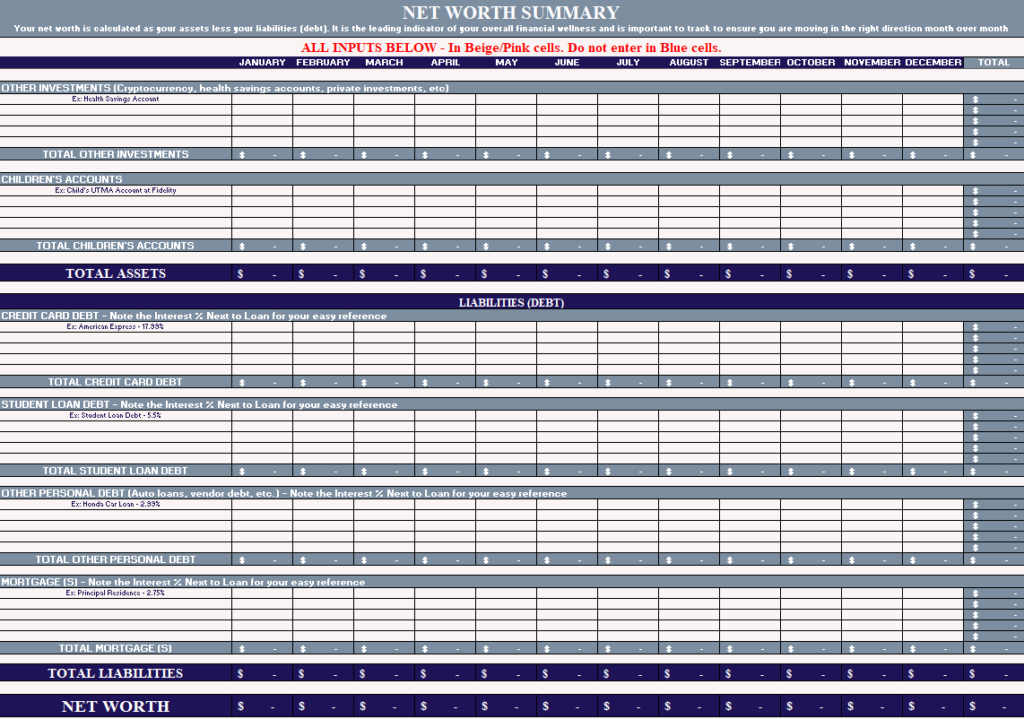

Net Worth Template

The net worth tab is strictly a spreadsheet for you to track your net worth on a monthly basis. It is one thing to track our money going in and going out but it is another thing to watch your net worth go up or down as a result of those financial choices.

Your net worth number equals your assets less your liabilities (debt). It is the key indicator of your overall financial health.

Being able to visualize it, understand what is driving it and identify where you really stand is an invaluable tool to motivate you and help you take the necessary steps to move forward.

On this particular tab, all you are required to do is input your different accounts into the appropriate asset or liabilities category and subsequently enter in the end of month balances. All of the totals will add up accordingly and will show you your total net worth on a monthly basis.

If this number is going up month by month – fantastic – you are paying down debt, saving more in your retirement accounts, etc. You are owning more and owing less.

If your net worth number is continuously going down, this is something to make note of and follow closely. It could be an indicator that you are overspending or taking on more debt and potentially over-exerting your finances.

Your net worth is a meaningful number and I hope by tracking it, you will begin to fully appreciate it.

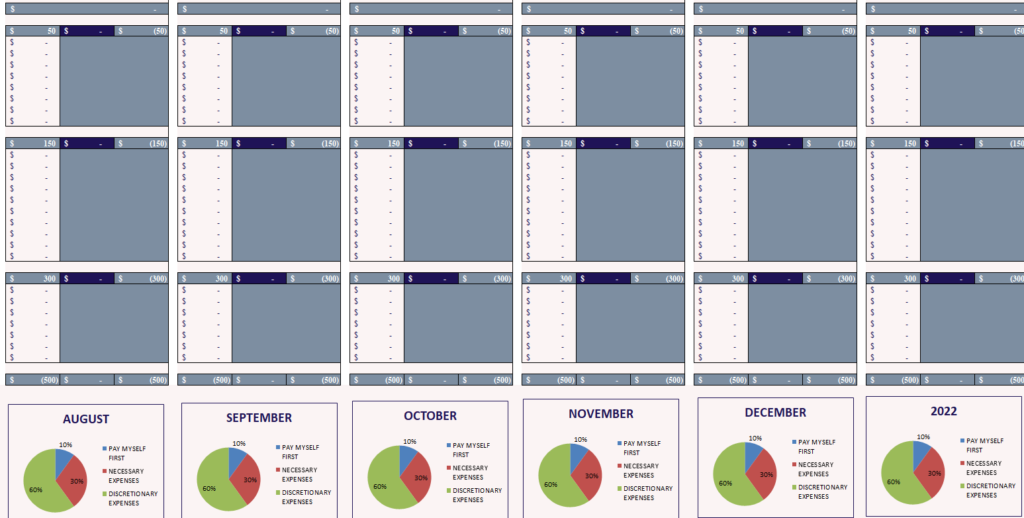

Budget Template

The budget tab will be primarily generated from the inputs you add in tabs January – December. All of your income, expenses and saving will flow directly to the appropriate “budget buckets” separated by Necessary, Discretionary and Pay Yourself buckets.

It will be a pain free, easy to use template for you to identify and track your progress around your actual financial habits vs. your budgeted financial goals.

The only input that you will make in the budget tab, is the section that is asking for the three percentages on how much you would like to allocate into each bucket. The suggestion is to attempt to make a 50/30/20 budget work for you, if you can. These are on after tax numbers (the income that goes into your bank account).

50% of after tax income spent on necessities, 30% of after tax income spent on discretionary expenses and 20% of after tax income spent on saving/investing/paying down debt.

This may not work for everyone. This may be too tight for you to start out. And that’s ok. Start where you are. Make small changes. I do not want you to make any drastic changes to your lifestyle all on day one because you know and I know, it won’t be sustainable going forward.

Your budget needs to be flexible, manageable and sustainable.

If we make things too tight upfront, we are more likely to give up on it. So start off with the numbers that work best for you. Then adjust over time.

The purpose of your budget is to create boundaries around your spending with the goal of directing your money exactly where you want. Setting these boundaries will create great opportunity for your money to be well spent or utilized with intention.

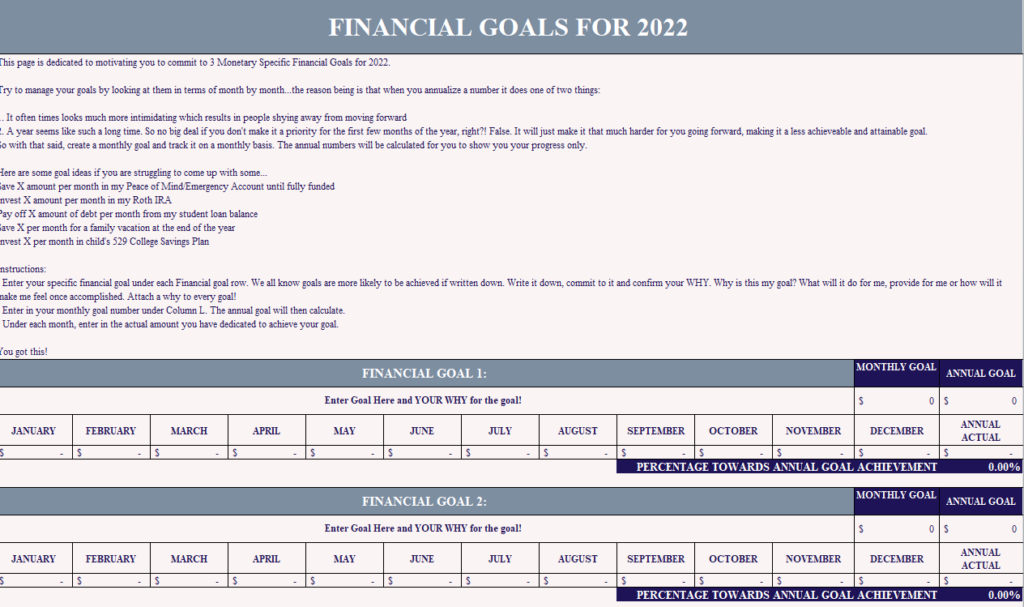

Financial Goal Progress Report

This financial goals progress report is dedicated to motivating you to commit to 3 Monetary Specific Financial Goals for 2022.

The template encourages you to manage your goals by looking at them in terms of month by month…the reason being is that when you annualize a number it does one of two things:

- It often times looks much more intimidating which results in people shying away from moving forward

- A year seems like such a long time. So no big deal if you don’t make it a priority for the first few months of the year, right?! False. It will just make it that much harder for you going forward, making it a less achievable and attainable goal.

Here are some goal ideas if you are struggling to come up with some…

Save X amount per month in Peace of Mind/Emergency Account until fully funded

Invest X amount per month in a Roth IRA

Pay off X amount of debt per month from a student loan balance

Save X per month for a family vacation at the end of the year

Invest X per month in child’s 529 College Savings Plan

You will enter your specific financial goals because we all know goals are more likely to be achieved if written down. Write it down, commit to it and confirm your WHY. Why is this my goal? What will it do for me, provide for me or how will it make me feel once accomplished. Attach a why to every goal!

Then each month you will enter in the actual amount you have dedicated to achieve your goal and the spreadsheet will provide you with insight into your progress.

Create Intention With Your Finances in 2022

This Wealth Tracker will be an incredible tool for you in taking ownership of your financial life, building awareness around your financial habits and making the changes necessary to build the financial life you want.

I hope this spreadsheet provides you with so much value going forward.

You can purchase the wealth tracker by clicking here!

Please reach out to me directly with any questions or concerns – I am available to help, always!

Follow @finpoweredfemale for more personal finance, tax, investing and business ownership tips on building wealth with confidence.