It’s that time of year again—tax season! Whether you’re wondering what tax documents you need or how to prepare for tax filing, getting organized now will reduce your stress later.

And let’s be honest — for some, tax season is a dreaded chore, while for others, it’s a chance to (hopefully) get some money back. Either way, getting organized now ensures you’re not leaving any money on the table.

As someone who’s spent years in the tax world—preparing, reviewing, and filing countless returns—I know firsthand how overwhelming this season can feel. But it doesn’t have to be.

That’s why I’ve put together this simple guide to stress-free tax prep.

With a little review of what to expect and a look back at what happened last year, you can tackle tax season like a pro!

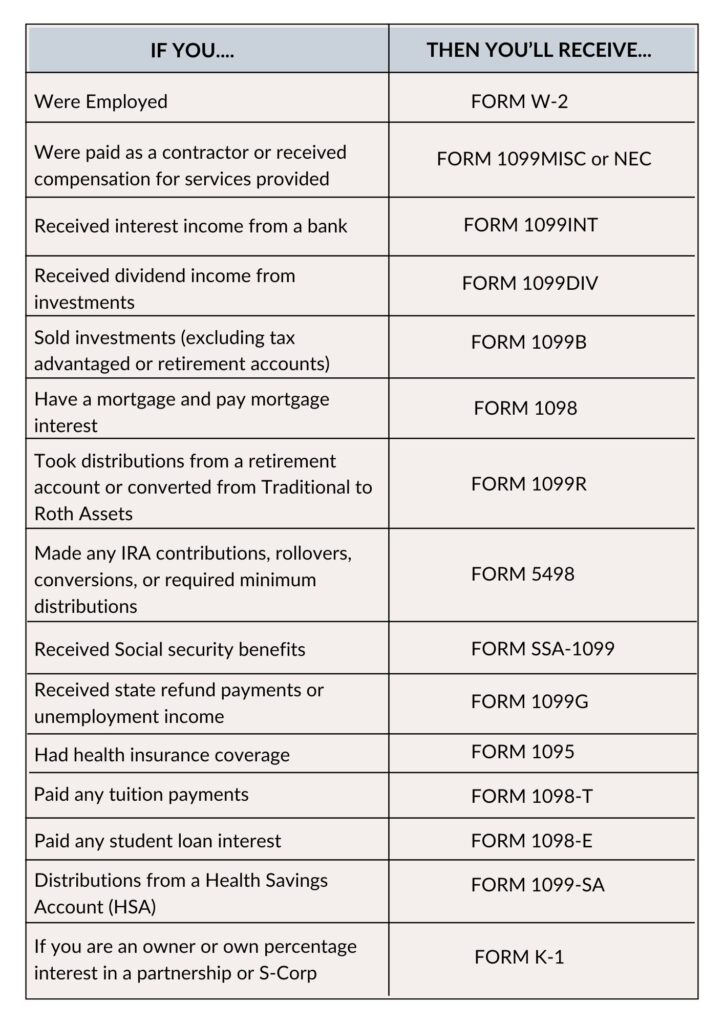

Essential Tax Documents You May Receive

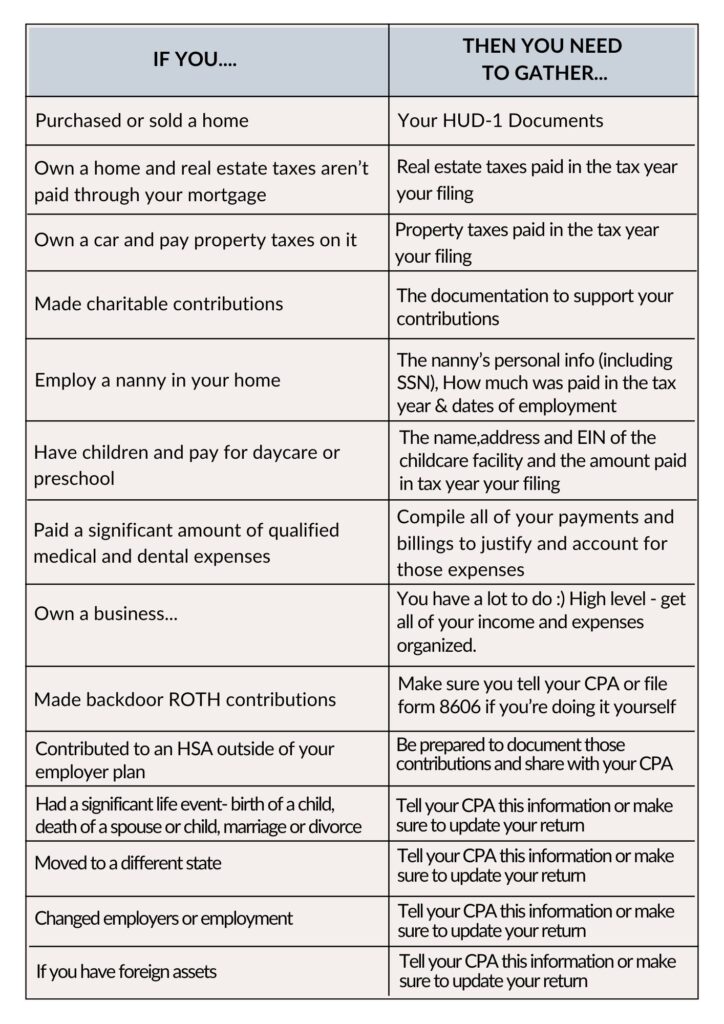

What You Need to Start Organizing for Tax Season

The #1 Mistake I Hope You Avoid This Tax Season

Too many people treat tax season like a one-and-done task—file your return, check if you owe or get a refund, then move on. But that approach? It’s likely costing you more than you think.

Instead, treat taxes as an ongoing part of your financial strategy. This is your opportunity to review your finances, fine-tune your savings, and ensure you’re not missing out on opportunities to save. A little planning now can make a huge difference down the line—whether it’s easing your stress (or your CPA’s!) and reducing the amount you pay in taxes.

And here’s a key thing to remember: tax season is NOT the time to strategize with your CPA. By the time you’re filing, most of the major decisions are already made for the year. Tax planning needs to happen during the tax year, not after it’s over.

So, don’t wait until the last minute. Don’t just go through the motions—start organizing your documents now and use this time to stay engaged with your financial goals.

The effort you put in today will make tax season smoother and give you more control over your financial future.

Resources:

For more details on the specific forms, check out the IRS website here.

If you’re looking for more tax related guidance and blog post, click here.