The updates to the 2026 IRS limits is something you’ll want to pay attention to, because when we talk about money, it’s not just about saving more, it’s about staying engaged and aware of how the rules around you are changing. Typically, each year the annual contribution limits will change each year and those little updates can quietly make a big difference in your future wealth.

And right now, the IRS has rolled out several updates for 2026 that will impact a lot of people.

Knowing what’s coming gives you the chance to plan and adjust early and make smarter decisions, not reactive ones months down the road.

I’ve said it before and I’ll say it again; in order to minimize your taxes…your money has to do something or go somewhere…it doesn’t just magically happen.

You choose where it goes, and if you’re not intentional, it might be headed to the IRS instead of your future. I don’t want that for you.

So, the difference? It starts with being aware of the rules and continual changes year after year.

What’s Changing in 2026

1. Contribution Limits Are Increasing

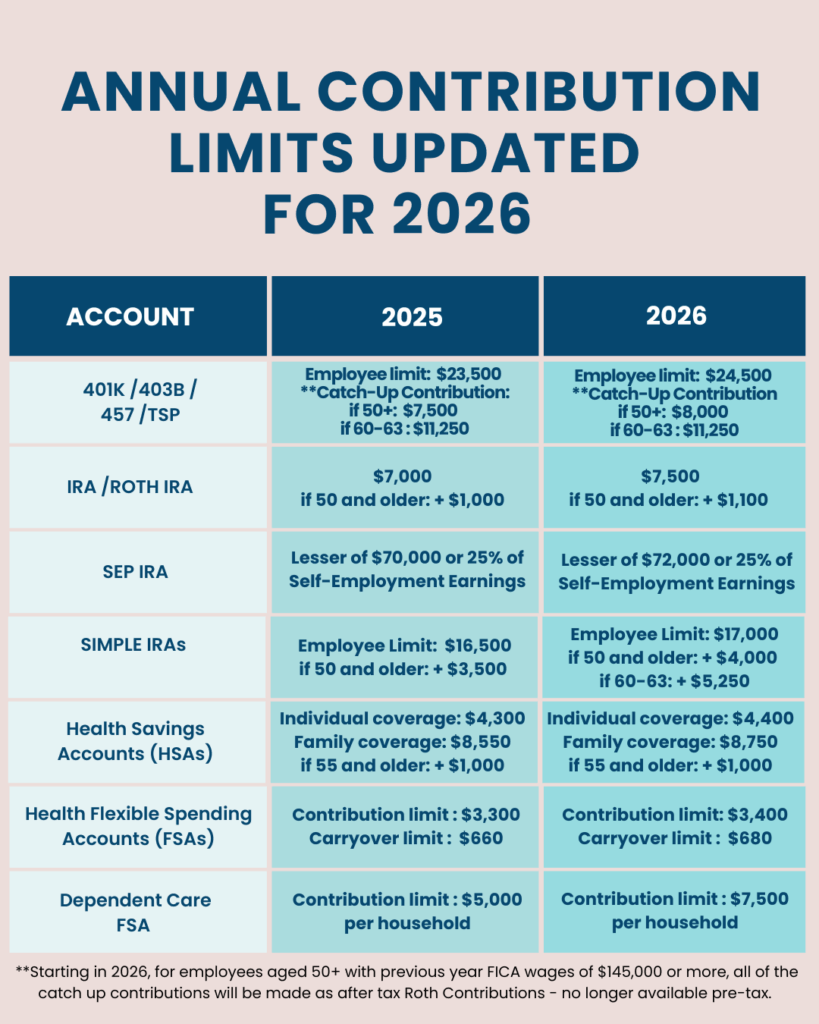

Inflation adjustments have been made across the board, meaning that you’ll be able to stash more in your retirement and health related accounts next year.

Employer Provided Retirement Accounts…Like 401K, 403B, TSP and 457 Plans

- Employee contribution limit: $24,500 (up from $23,500 in 2025)

- Catch-up (age 50+): $8,000 (up from $7,500)

- Special catch-up (if ages 60–63): $11,250 (unchanged)

IRA Accounts (Traditional & Roth)

- Under 50: $7,500 (up from $7,000)

- Catch-up (50+): $1,100 (up from $1,000)

SEP IRAs – (For My Business Owners!)

- Contribution limit: Max is lesser of $72,000 (up from $70,000) or 25% of self-employment earnings

SIMPLE IRAs

- Contribution limit: $17,000 (up from $16,500)

- Catch-up (50+): $4,000 (up from $3,500)

- Special catch-up (ages 60–63): $5,250 (new update)

Health Savings Accounts (HSAs)

- Individual coverage: $4,400 (up from $4,300)

- Family coverage: $8,750 (up from $8,550)

- Catch-up (55+): Still $1,000

Health Flexible Spending Accounts (FSAs)

- Contribution limit: $3,400 (up from $3,300)

- Carryover limit: $680 (up from $660)

Dependent Care FSA Limit Rises

- Contribution limit: $7,500 (up from $5,000)

- This is a big win for working families giving them more flexibility to set aside pre-tax dollars for day care and after school programs – an expense they would be paying for regardless.

- HERE’S THE CATCH: Employers need to make sure they update their plans to accommodate this new limit. Check in with them!

2. Big Change! Mandatory Roth Catch-Up Contributions for High Earners

Starting Jan. 1, 2026 (for most plans), if you’re 50 or older and earned more than $145,000 in 2025 (in FICA wages – you can check your paystub), you’ll be required to make catch up contributions on a Roth (after tax) basis.

**This will impact your take home money AND taxes if you were already in this age group making catch up contributions prior to 2026 so be aware of that!

This rule comes from the Secure 2.0 Act and affects participants in 401K, 403B, and government 457B plans.

Here’s the takeaway:

- You’ll pay taxes on your catch-up contributions now, not later.

- Your future withdrawals, as it relates to the after tax contributions, in retirement will be tax-free.

- Employers need to ensure their plans offer a Roth option, so make sure your company is ready.

- What you need to do: Check prior year wages. Ask your employer/plan if they’ll require catch ups to be Roth. If yes, decide if you want to continue catch ups, switch strategies, or re-evaluate your overall plan.

3. Standard Deduction Changes

- Standard deduction increases:

- Married filing jointly: $32,200

- Single: $16,100

- Head of household: $24,150

- Bonus deduction for seniors (age 65+): A temporary $6,000 “extra” deduction if you meet certain income limits from 2025-2028.

4. The SALT Deduction (Aka Your State and Local Tax Deduction IF You Itemize)

If you itemize your deductions, this is a big win for people in high-tax states or anyone paying significant state, local, or property taxes.

In the past, the SALT deduction was capped at $10,000, but starting in 2025, that cap jumps to $40,000 and then again to $40,400 for 2026 – yes, with some income limitations to be aware of.

What does that mean? Simply put, if you’ve been paying a lot in state or local taxes, you could finally get credit for a larger portion of those payments, reducing your taxable income and giving your wallet a bit of relief.

5. Annual Gift Tax Exclusion for 2026

If you’re thinking about giving gifts or are receiving them, know that the annual gift tax exclusion for 2026 stays at $19,000 per person, the same as 2025. That means you can give up to that amount to as many people as you like without having to file a gift tax return.

Here’s how it breaks down:

- Individual gifts: Up to $19,000 per recipient per year.

- Married couples: Combine your exclusions to give up to $38,000 per recipient without touching your lifetime gift tax exemption.

It’s a simple but powerful way to move money to loved ones without triggering extra tax paperwork and a tool to think about if you’re planning for generational wealth.

Why These Updates to 2026 IRS Limits Matter for You Right Now

- Before the end of the year is a good time to update your 2026 elections and start right from the beginning of the year

- If you’re over 50, those catch-up changes can make a material difference in how much you save, how much ends up in your pocket from your paycheck and ultimately how you’re taxed. With that said, it will be beneficial to understand how this change impacts you directly.

- And if you’re thinking about generational wealth, kids & money, or future flexibility, these are the building blocks you set now and be proactive about as opposed to reactive.

Having a financial plan isn’t about being perfect , it’s about finally having clarity. You deserve a roadmap that’s tailored to your life, not a cookie-cutter template. A real plan helps you see where you’re going, what’s possible, and the steps to get there.

But planning alone isn’t enough. You also need a simple, time efficient system that keeps your finances running smoothly in the background especially when life gets busy. That’s where I come in. With expert 1:1 guidance, proven strategies, and ongoing support, I help you build a financial life that feels organized, confident, and entirely aligned with your goals.